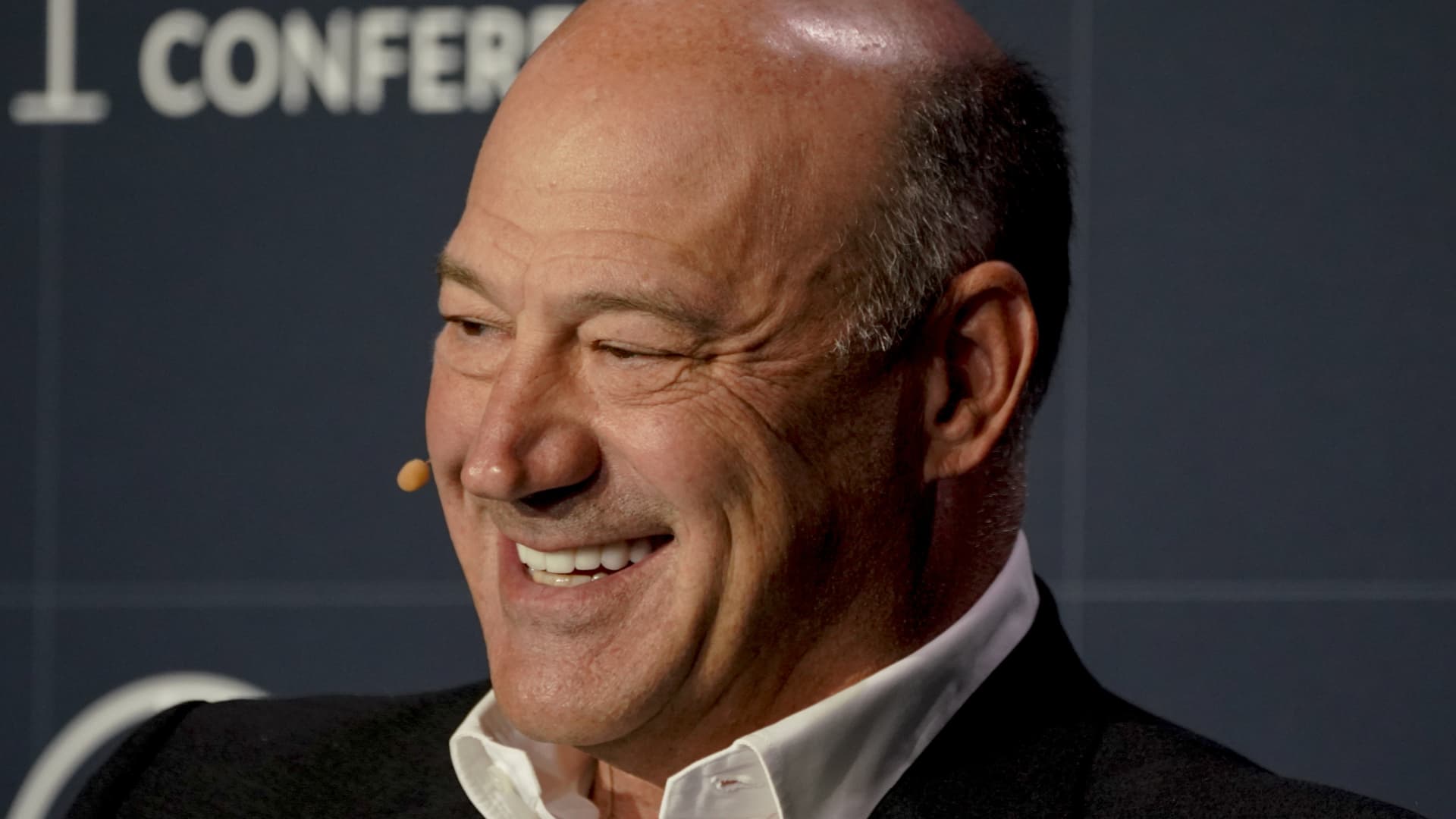

The U.S. Economy is Back to Normal, According to Gary Cohn, IBM Vice Chairman

Gary Cohn, vice chairman of International Business Machines Corp. (IBM), recently stated at the Milken Institute Global Conference in Beverly Hills that the U.S. economy is now “back to normal” for the first time in two decades. He also expressed his concern about the market getting ahead of the likely pace of interest rate cuts. This statement has sparked discussion and debate among economists and investors.

Market Expectations for Interest Rate Cuts

According to Cohn, the market is narrowly pricing a first rate reduction from the Federal Reserve in May 2024, with around 100 basis points of cuts expected across the year. This is based on CME Group’s FedWatch tool. The central bank had paused its historically aggressive monetary tightening cycle in September, with the Fed funds rate target range at 5.25-5.5%, up from just 0.25-0.5% in March 2022. However, Cohn believes that the Fed will not start to unwind its position until at least the second half of next year.

Cohn’s Perspective on Fed Rate Activity

As the former chief economic advisor to president Donald Trump, Cohn does not see the Fed making any rate moves in the first half of 2024. He predicts that only in the third quarter will there start to be some forward guidance of lower rates. This stance is supported by the U.S. consumer price index, which increased 3.2% in October from a year ago. Despite the sharp rise in interest rates, the U.S. economy has remained resilient, avoiding a widely predicted recession.

Cohn’s Assessment of the Current Financial Landscape

Cohn highlighted that U.S. consumer debt has soared to record highs of over $1 trillion, and that consumer spending is persisting despite tightening financial conditions. He believes that the economy is “back to a normal, but we all forgot what normal is.” He also noted that the 10-year U.S. Treasury yields have moderated from the 16-year high of 5% and inflation is “running back towards the mean” of between 2% and 2.5%. This indicates that every piece of economic data is heading back towards its very long-term average.

Conclusion

Cohn’s insights are significant as they offer a unique perspective from an industry expert. His views on the U.S. economy and potential rate cuts from the Federal Reserve provide valuable insight for investors and economists alike. As the market continues to digest this information, it will be interesting to see how the economy and interest rates evolve in the coming months.